Tsp installment payment calculator

My Account Plan Participation Investment Funds Planning and Tools Life Events and. Deferrals can be for up to 180 days in a 365 day period or for the duration of the Service members active duty plus 60 calendar days whichever is less.

Tsp Calculator Shop 53 Off Www Wtashows Com

This calculator is intended for use by US.

. Both the installment payment options and the TSP annuity option can provide a predictable regular stream of payments into your bank account. It can also be used to help fill steps 3 and 4 of a W-4 form. Here is the Social Security Survivors Benefits Calculator for further reference.

9465 Installment Agreement Request. Forgot your account number or user ID. TSP Installment Payment Calculator.

Since a joint life payment stream covers two people and is likely to last longer than a single life stream the amount of the payment is typically lower. Lost equity portion of settlement payment. It was established by Congress in the Federal Employees Retirement System Act of 1986 and offers the same types of savings and tax benefits that many private corporations offer their employees.

As of September 15 2019 you now have more options for how and when you can access money from your TSP account. Please enquire your latest payment result on the i-banking service. How many payments will you receive and how long.

After buying and consuming Stoner Patch Dummies Grape makes you relieve sound and comfortable. All Payer Model Accountable Care Organization ACO is the Centers for Medicare Medicaid Services CMS new test of an alternative payment model in which the most significant payers throughout a jurisdiction come under the same payment structure for the majority of providers throughout the jurisdictions care delivery system to transform. If you lost your main home in foreclosure you should treat the lost equity payment as an additional amount you received.

There is a 150 fee to register. Property taxes on the Service members primary residence. 4 FAH-3 H-54610 TSP Account Statements.

Edibles as a whole come in various design and forms. Compare auto loan rates and discover how to save money on your next auto purchase or refinance. Doing so will clear the pathway for your survivors to receive any balance you have in the TSP which is like a 401k.

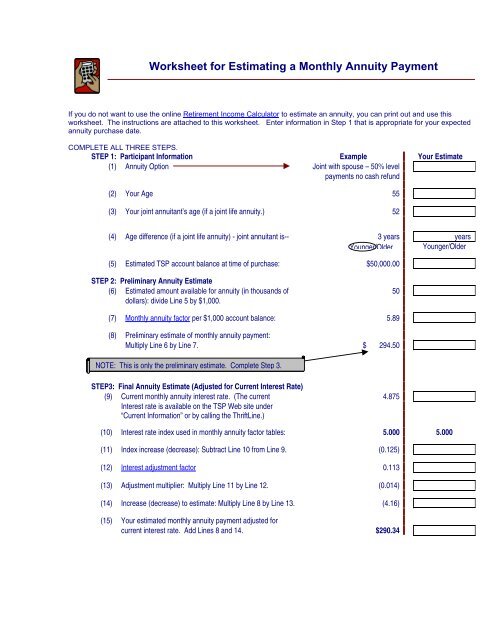

Stoner Patch Grape Dummies 500mg online for a great flavored experience. As a result of the June 2020 CARES Act retirement account holders affected by the Coronavirus could access up to 100000 of their retirement savings as early withdrawals penalty free with an expanded window for paying the income tax they owed on the amounts they withdrew. If you currently receive monthly payments and want to choose a different amount use this calculator to estimate.

However the TSP annuity is less flexible because you cant reverse the one-time transaction of converting your TSP to annuity payments. Retail installment contracts. If you received a corrective payment of excess annual additions you should receive a separate Form 1099-R for the year of the payment with code E in box 7.

The following COVID information was for 2020 Returns. This means that in order to transfer your entire payment you must use other funds to make up the 20 withheld. 4 FAH-3 H-5469 Loans CTFMP-65.

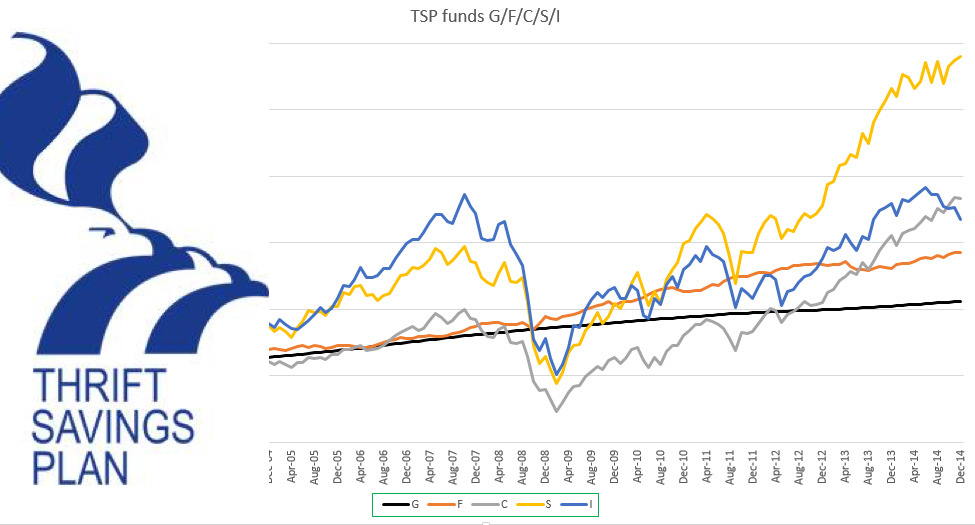

If you are interested in comparing all of the TSP monthly income options including TSP monthly payments and life annuities. 721 Tax Guide to US. The regular 10 early.

The bill payment service is powered by EPSCO that covers over 500 merchants in a wide range of services. Civil Service Retirement Benefits and TSP-536. Can I withdraw money from my TSP without penalty.

Thus an exemption is allowed for distributions from defined contribution plans or other types of governmental plans such as the TSP. A joint life annuity is also available. Installment loan rates.

For more details see Thrift Savings Plan TSP in Part II of Pub. 08-29-2011 If the employee obtains a loan from hisher TSP account the payroll office will facilitate repayment through recurring deductions from biweekly pay to the TSP in accordance with the Loan Agreement. Report the total payment shown in box 1 of Form 1099-R on line 5a of Form 1040 or 1040-SR.

If it is special holiday eg. What are the main features of the bill payment service in the i-banking. The TSP is required to withhold 20 of your payment for federal income taxes.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major. If you have a TSP account its important that you designate a beneficiary.

Learn more about the California Military Families Financial. If you are currently receiving monthly payments and want to choose a different amount use this calculator to estimate how many payments you will receive and how long they will last. Any person or entity who will be responsible for the payment of a surcharge on more than one trip in any calendar month must register with the New York State Tax Department by completing an online application and obtaining a certificate of registration which will be valid for the specified term on the certificate and is subject to renewal.

See IRC Section 72t10 as amended by the Defending Public Safety Employees Retirement Act PL. The Thrift Savings Plan TSP is a retirement savings and investment plan for Federal employees and members of the uniformed services including the Ready Reserve. However TSP deductions are subject to FICA taxes.

Get expert advice on auto loans. Thus highly recommended for adults. This option guarantees a monthly payment to you and a spouse or someone you designate other than a spouse for the rest of your lives.

Medicated sour These treat now comes infused with cannabis. TSP Installment Payment Calculator. This TSP calculator will help you decide which option is right for you by comparing the available options and features that might meet your needs.

Also the restriction that only defined benefit plans qualify for the exemption is eliminated. The Thrift Savings Plan TSP is a lot like a 401k plan on steroids and its available to government workers. Typhoon the actual payment date will possibly be delayed.

A corrective payment consisting of your after-tax contributions isnt taxable. You cant make adjustments to the purchased annuity but you. Saving money on interest costs by lowering your monthly payment and or the term number of years you pay the loan Getting rid of an adjustable-rate loan which have less stable monthly payments.

The TSP will withhold 10 of the payment for federal income tax unless you gave the TSP a Form W-4P to choose not to have tax withheld. Thrift Savings Plan and Savings Deposit Program. If the entire TSP account balance is paid to the beneficiaries in the same calendar year it may qualify as a lump-sum distribution eligible for the 10-year tax option if the plan participant was born before.

If you do not roll over the entire amount of your payment the non-transferrable portion will be taxed. The TSP can also transfer all or part of any single payment or in some cases a series of monthly payments to a traditional IRA or eligible employer plan.

2

Thrift Savings Plan Transition Dates For New Features Start May 16

Installments Vs Annuity Using Your Tsp For Regular Income

Tsp Calculator Shop 53 Off Www Wtashows Com

Is The Tsp Annuity A Good Deal

2

2

Tsp Calculator Store 55 Off Www Wtashows Com

Tsp Calculator Shop 53 Off Www Wtashows Com

2

Critical Aspects Of Tsp Installments

Tsp Calculator Shop 53 Off Www Wtashows Com

Tsp Calculator Hot Sale 53 Off Www Wtashows Com

2

2

Tsp Calculator Online 50 Off Www Wtashows Com

2